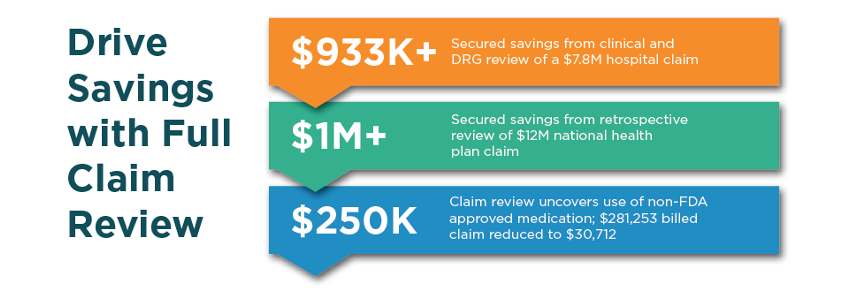

Secured Savings with Full Claim Review

With payment errors or overpayments expected to cost up to $560 billion, or 7-10% of healthcare spending in 2026, payers need solutions that maximize appropriate savings on every claim. By leveraging data across the life of a claim – and the patient journey – Vālenz® Health has become the health plan’s partner of choice, offering Full Claim Review as part of our robust, end-to-end suite of Payment Integrity solutions.

Full Claim Review validates that care was medically necessary, provided by credentialed providers, and aligned with contracted requirements before applying our detailed claim review. Supported by AI and our expert coding and clinical review teams, we complement the health plan’s payment integrity capabilities with unique and proprietary methodologies, delivering savings that continuously exceed expectations.